Owning a home is a significant milestone, but knowing your monthly mortgage payments is essential from the start. Many factors influence your payment amount, such as the loan amount, interest rate, and loan term. You can easily estimate your payments using online tools. These tools allow you to plug in different figures to see how they change your monthly payment.

- Be sure to consider property taxes and homeowners insurance when determining your total monthly housing costs.

- Getting acquainted yourself with these values will help you make a more accurate budget and reach your homeownership goals.

Determine Your Home Loan Affordability

Figuring out how much home loan you can truly handle is a crucial first step in your home buying journey. It's more than just looking at your monthly earnings. A comprehensive affordability calculation takes into account your expenses, financial obligations, and down payment amount. By carefully evaluating these factors, you can set a realistic budget and avoid exceeding your finances.

- Factor in all of your monthly expenditures, including housing, transportation, food, entertainment, and savings goals.

- Assess your debt-to-income ratio (DTI), which compares your total monthly debt payments to your gross monthly income.

- Get pre-approved for a mortgage to see what loan amounts lenders are willing to offer you.

Keep in mind that your home loan affordability is just an estimate. Situations such as interest rates and property prices can modify your final loan amount. It's always best to consult with a qualified mortgage advisor for personalized guidance.

Home Loan Calculator

A Mortgage Payment Simulator is an invaluable asset for prospective buyers. This online platform allows you to determine your monthly mortgage payments based on various factors, such as the loan amount, interest rate, and loan term. By entering these details, you can gain a accurate understanding of your potential financial obligations. A Mortgage Payment Simulator facilitates informed decision-making, assisting you to choose a mortgage that aligns your budget and financial goals.

Unlock Your Potential with Our Mortgage Calculator

Figuring out how much house you can afford can feel overwhelming. Don't worry Our easy-to-use mortgage calculator can help you determine your budget quickly. Just enter a few factors, and we'll give you a personalized estimate. It's a excellent way to get where you stand and take informed choices.

- Start your homebuying journey with confidence.

- Uncover your buying power today.

Determine Your Dream Home Budget

Finding your ideal dwelling can be an exhilarating journey. Though, before you get swept away by beautiful listings and open houses, it's crucial to calculate a realistic budget. This financialplan will serve as your guidepost throughout the entire home-buying process. Initially, take an honest look at your current finances. List all your income sources and meticulously track your expenses. This in-depth analysis will give you a clear understanding of how much you can comfortably handle to spend on a mortgage payment each month.

Once you have a stable grasp of your monthly income, it's time to explore different loan options. Consult with a mortgage lender to review your possibilities. They can help you understand the diverse types of mortgages available and suggest one that best matches your financial situation.

Finally, setting a realistic home budget is crucial to finding a dream home that you can truly afford. By carefully planning and evaluating your financial circumstances, you'll be well on your way to achieving your homeownership goals.

Find Your Monthly Mortgage Payments

A Home Loan Amortization Calculator is a valuable tool to help you figure out your monthly mortgage payments. This calculator takes into account the principal, interest rate, and loan term to produce a detailed amortization schedule.

- With using this calculator, you can visualize exactly how much of each payment goes toward the principal.

- It also illustrates the sum of interest paid over the life of the loan.

- Understanding your amortization schedule can help you make informed decisions about your mortgage, such as choosing a shorter or longer loan term.

Neve Campbell Then & Now!

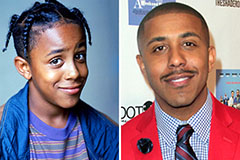

Neve Campbell Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! Michael Jordan Then & Now!

Michael Jordan Then & Now! Nadia Bjorlin Then & Now!

Nadia Bjorlin Then & Now! Sarah Michelle Gellar Then & Now!

Sarah Michelle Gellar Then & Now!